Navigating the Upcoming Tax Changes: A Guide to Australia's 2025 Tax Brackets

Table of Contents

- 001-AUSTRALIAN INDIVIDUAL INCOME TAX RATES 2023 / 24 - YouTube

- Australia Tax Bracket 2024-2025: Highest and Lowest Tax in Australia

- Tax bracket creep costing every Australian worker more than a decade ...

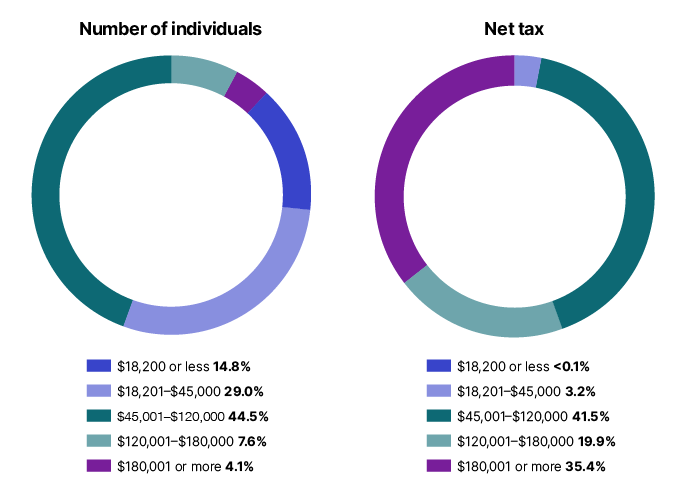

- Individuals statistics | Australian Taxation Office

- Fact file: How much extra tax are Australians expected to pay because ...

- New Tax Brackets 2024 Australia Pdf - Debee Nataline

- Understanding the Australian Tax Rates 2024–25 | Tax Accounting Adelaide

- Believe it or not...1 in 3 Australian households has net wealth of more ...

- Aus Tax Rates - Spot Walls

- Stage three tax cuts: Bracket creep will put 1m Aussies into top tax ...

What are the New Tax Brackets for 2025?

How will the New Tax Brackets Affect You?

Tax Implications for Businesses

The new tax brackets will also have implications for businesses, particularly those with employees. Employers will need to adjust their payroll systems to reflect the updated tax rates, ensuring that their employees' tax deductions are accurate. Additionally, businesses may need to reassess their tax strategies, considering the changes to the tax brackets. This could involve reviewing their income structures, expenses, and tax deductions to minimize their tax liability. The new tax brackets for 2025 are set to bring significant changes to Australia's tax landscape. Understanding these changes is crucial for individuals, families, and businesses to navigate the updated tax system effectively. By being aware of the new tax brackets and their implications, Australians can make informed decisions about their finances and plan for the upcoming financial year. As the 2024-2025 income year approaches, it's essential to stay up-to-date with the latest tax developments and seek professional advice if needed. By doing so, you can ensure that you're taking advantage of the available tax relief and minimizing your tax liability.For more information on the new tax brackets and how they may affect you, visit the Australian Taxation Office website or consult with a tax professional.

Note: The information provided in this article is general in nature and should not be considered as tax advice. It's always recommended to consult with a tax professional or financial advisor for personalized advice.